Will South Korea Have to Bomb the North, Eventually?

2016 Cuban Missile Crisis?

This situation has not garnered the attention it deserves in the press nor by the markets. Should tensions escalate to the point of causing a nuclear event then such an engagement could lead to wider actions bringing the involvement of respective allies and the bigger powers.

Even the limited use of nuclear weapons places the world in greater peril than most appreciate or know at first glance. Why? Russia operates a mechanized nuclear defence program that is often termed and referred to as " the dead-hand system" because the missile-launch- order can be triggered when its sensors determine that the radioactivity in the atmosphere is beyond preset acceptable levels. Breaching of these tests causes the system to conclude and assume that a nuclear attack is being carried out against their nation and it will then automatically order the launch of Russian missiles aimed at predetermined targets.

There is no human involvement.

Originally the system was designed to provide for an immediate retaliatory strike in the event that the leadership in the Kremlin was destroyed

by a first strike by an aggressor,

and thus decapitating the decision-making powers ability to respond. The premise of the system embraces the cold war assumption that the threat of mutual annihilation would deter the superpowers, at the time, from ever entering into any confrontations using nuclear weapons.

However, today this old and perhaps antiquated system could inadvertently launch missiles because the sensors detect the radiation from a much smaller nuclear conflict. Right now, as long as tensions remain high in North Korea there is a great danger that aggressions could expand rapidly into the global theatre. Such a possibility, to our knowledge has not been experienced since the Cuban Missile Crisis, in 1962, when the world was was gripped by fear and just seconds away from a global nuclear war that could have wiped out all of humanity in mere days.

In light of the concerns mentioned, and their potential consequences and devastation - this situation is to be given the highest priority and attention in the days and weeks ahead. It is also noted that certain US Presidential candidates indicated, in February, that they would approve a preemptive strike against North Korea - that does not sound like such a good idea should it also lead to those same sensors detecting and acting upon excessive radioactivity in the atmosphere. Moreover, leadership in North Korea is far from stable or sensible - you have a child holding a loaded gun.

In the last analysis, the world again is walking on eggshells; one misstep having frightening ramifications

Even the limited use of nuclear weapons places the world in greater peril than most appreciate or know at first glance. Why? Russia operates a mechanized nuclear defence program that is often termed and referred to as " the dead-hand system" because the missile-launch- order can be triggered when its sensors determine that the radioactivity in the atmosphere is beyond preset acceptable levels. Breaching of these tests causes the system to conclude and assume that a nuclear attack is being carried out against their nation and it will then automatically order the launch of Russian missiles aimed at predetermined targets.

There is no human involvement.

by a first strike by an aggressor,

and thus decapitating the decision-making powers ability to respond. The premise of the system embraces the cold war assumption that the threat of mutual annihilation would deter the superpowers, at the time, from ever entering into any confrontations using nuclear weapons.

Panic Grows as Moody's Cuts China's Rating Outlook

China Another Enron?

Really, when you think about it , what is the difference between the two, when they both are great benefactors of ghosts and zombies and then go on to apply the most opaque and misleading accounting practises, at all levels of organization with utter impunity? No wonder investors and creditors are heading for the hills. To answer the question: there is no difference - and the results are sure to be the same.

Now that brings up the next question regarding Bernie Madoff...

Methane Time Bomb Closer Than Feared?

The Big Question

Any day now? Any moment? But at how many parts per billion do we actually have the same atmospheric conditions as the Permian extinction? Once we know that - then with a little math we could probably determine the next poorly planned and unfortunate event in the planet's history.

Remember too, that a failure to plan - is a plan to fail!

"

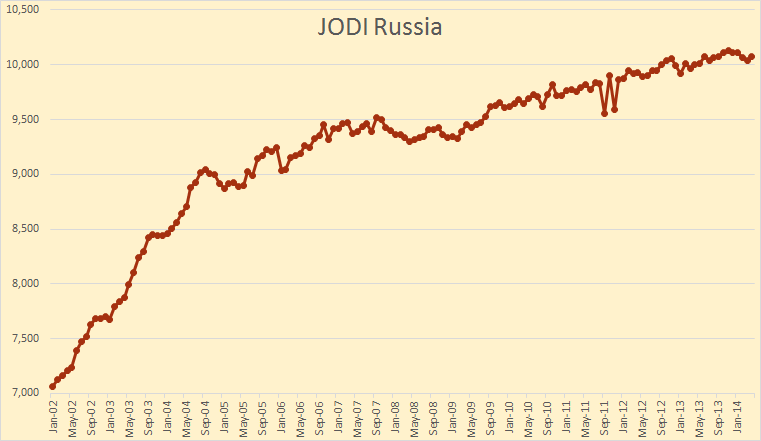

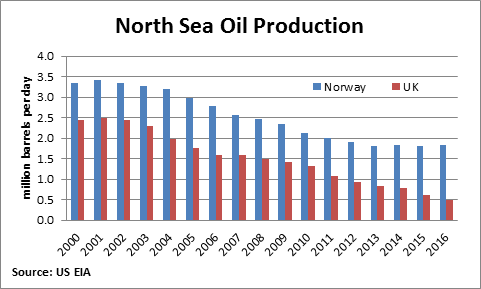

Peak Oil Today

"

- 29 Feb 2016

The very best weekly analysis and evaluation of the global peak oil situation with additional briefings, charts and videos, added by the curator from accredited professional

Everyone should "Bookmark ' this very important weekly post to stay abreast of this most critical aspect of global economics and life on this planet.

To subscribe or unsubscribe

,

please

email

us at