Today's ENERGY News

March 30, 2016

March 30, 2016

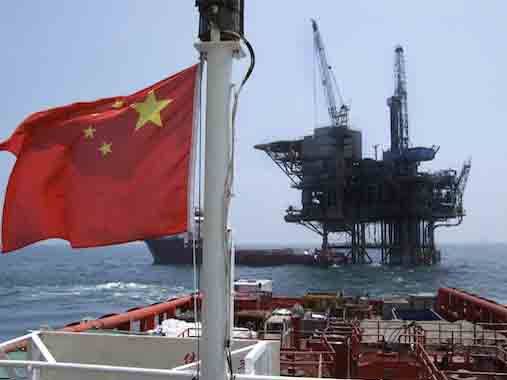

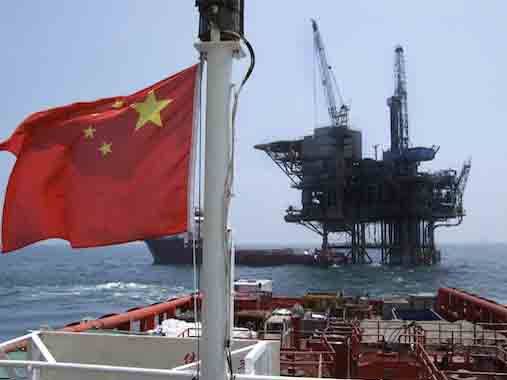

China’s oil giants hit hard by oil slump

Plunging global crude oil prices crimped 2015 earnings for China’s trio of oil companies, according to their annual reports. China National Offshore Oil Corporation (CNOOC), China’s largest offshore oil and natural gas developer, made 20.2 billion yuan (3.1 billion U.S. dollars) in net profits last year, plunging 66.4 percent year on year. Net profits of PetroChina Co. Ltd., China’s top oil and gas producer, shrank 66.9 percent to 35.52 billion yuan in 2015, the lowest profit since 1999. Sinopec, China’s largest oil refiner, saw its net profits decline 30 percent year on year to 32.4 billion yuan in 2015. The continued slump in global crude oil prices, downward pressure on the domestic economy and sluggish demand for oil and gas have caused the profit plunge for the oil giants, said Dong Xiucheng, professor with China University of Petroleum. Brent crude, the benchmark for more […]

Plunging global crude oil prices crimped 2015 earnings for China’s trio of oil companies, according to their annual reports. China National Offshore Oil Corporation (CNOOC), China’s largest offshore oil and natural gas developer, made 20.2 billion yuan (3.1 billion U.S. dollars) in net profits last year, plunging 66.4 percent year on year. Net profits of PetroChina Co. Ltd., China’s top oil and gas producer, shrank 66.9 percent to 35.52 billion yuan in 2015, the lowest profit since 1999. Sinopec, China’s largest oil refiner, saw its net profits decline 30 percent year on year to 32.4 billion yuan in 2015. The continued slump in global crude oil prices, downward pressure on the domestic economy and sluggish demand for oil and gas have caused the profit plunge for the oil giants, said Dong Xiucheng, professor with China University of Petroleum. Brent crude, the benchmark for more […]

BP to Lay Off 500 Workers in Houston

BP plc, headquartered in the UK, has announced it will lay off 500 of its workers in Houston. According to a letter to the Texas Workforce Commission, the oil and gas super major will lay off many of the employees beginning in early June and affected employees will receive written notice at least 60 days ahead of their separation date. The Houston workforce reductions are part of BP’s larger plan to cut 4,000 jobs globally in its upstream segment in 2016, company spokesperson Jason Ryan confirmed in an email to Rigzone. This is what is required to adapt to the protracted low oil price environment, and BP is taking the steps necessary to reduce costs and ensure we are structured to compete as efficiently as possible, Ryan said. BP has seen many changes this year, namely its announcement to cut thousands of jobs globally through 2017 as well as […]

BP plc, headquartered in the UK, has announced it will lay off 500 of its workers in Houston. According to a letter to the Texas Workforce Commission, the oil and gas super major will lay off many of the employees beginning in early June and affected employees will receive written notice at least 60 days ahead of their separation date. The Houston workforce reductions are part of BP’s larger plan to cut 4,000 jobs globally in its upstream segment in 2016, company spokesperson Jason Ryan confirmed in an email to Rigzone. This is what is required to adapt to the protracted low oil price environment, and BP is taking the steps necessary to reduce costs and ensure we are structured to compete as efficiently as possible, Ryan said. BP has seen many changes this year, namely its announcement to cut thousands of jobs globally through 2017 as well as […]

Oklahoma’s governor defends earthquake response

Oklahoma’s governor defended the state response to the seismic activity attributed to oil and gas development against a federal report on the hazard. “Oklahoma remains committed to doing whatever is necessary to reduce seismicity in the state,” Gov. Mary Fallin said in a statement. Her comments followed the release of the first-ever report from the U.S. Geological Survey on human-induced seismic activity in the country. A map produced by the USGS shows Oklahoma is the state with the highest risk of potential hazard from human-induced seismic activity. Last year, the USGS found evidence to suggest seismic activity in the state may be tied to the disposal of wastewater from the oil and gas […]

Oklahoma’s governor defended the state response to the seismic activity attributed to oil and gas development against a federal report on the hazard. “Oklahoma remains committed to doing whatever is necessary to reduce seismicity in the state,” Gov. Mary Fallin said in a statement. Her comments followed the release of the first-ever report from the U.S. Geological Survey on human-induced seismic activity in the country. A map produced by the USGS shows Oklahoma is the state with the highest risk of potential hazard from human-induced seismic activity. Last year, the USGS found evidence to suggest seismic activity in the state may be tied to the disposal of wastewater from the oil and gas […]

China Natural Gas Price Cuts Seen Luring Customers From Coal

China’s natural gas demand has been boosted by price cuts aimed at switching users from coal to the cleaner-burning fuel, according to one of the country’s biggest gas distributors. ENN Energy Holdings Ltd. has seen its sales rise more than 15 percent in January and February as lower prices encouraged customers to switch, Vice Chairman Cheung Yip Sang said in an interview in Hong Kong. ENN expects full-year sales to rise 15 percent, following last year’s 11.5 percent jump to 11.3 billion cubic meters. “The movement really picked up a lot of momentum,” Cheung said. “The higher burning efficiency of gas and government pressure for better emission standards will help convert more industrial users from coal to gas.” President Xi Jinping’s government adjusted gas prices twice last year to stimulate demand and shift consumption from coal, which makes up 64 percent of the country’s energy mix. The share of […]

China’s natural gas demand has been boosted by price cuts aimed at switching users from coal to the cleaner-burning fuel, according to one of the country’s biggest gas distributors. ENN Energy Holdings Ltd. has seen its sales rise more than 15 percent in January and February as lower prices encouraged customers to switch, Vice Chairman Cheung Yip Sang said in an interview in Hong Kong. ENN expects full-year sales to rise 15 percent, following last year’s 11.5 percent jump to 11.3 billion cubic meters. “The movement really picked up a lot of momentum,” Cheung said. “The higher burning efficiency of gas and government pressure for better emission standards will help convert more industrial users from coal to gas.” President Xi Jinping’s government adjusted gas prices twice last year to stimulate demand and shift consumption from coal, which makes up 64 percent of the country’s energy mix. The share of […]

Hedge funds establish near-record bullish bet on rising oil prices: Kemp

Hedge funds and other money managers have amassed a near-record number of bullish bets on increasing oil prices, helping push the main international benchmark well above $40 per barrel. By the close of business on March 22, money managers held a net long position equivalent to almost 579 million barrels in the three largest crude oil futures and options contracts ( tmsnrt.rs/1WU26ND ). Hedge funds have more than doubled their net long position from just 242 million barrels at the end of last year, according to an analysis of data published by regulators and exchanges. The net long position has passed the previous peak of 572 million barrels, set in May 2015, and is closing in on the record of 626 million, set in June 2014, when Islamic […]

Hedge funds and other money managers have amassed a near-record number of bullish bets on increasing oil prices, helping push the main international benchmark well above $40 per barrel. By the close of business on March 22, money managers held a net long position equivalent to almost 579 million barrels in the three largest crude oil futures and options contracts ( tmsnrt.rs/1WU26ND ). Hedge funds have more than doubled their net long position from just 242 million barrels at the end of last year, according to an analysis of data published by regulators and exchanges. The net long position has passed the previous peak of 572 million barrels, set in May 2015, and is closing in on the record of 626 million, set in June 2014, when Islamic […]

No comments:

Post a Comment